Earn Guaranteed TAX-FREE Monthly Rental Income from your eFLAT with ZERO Tenant

You pay absolutely ZERO Maintenance Cost, ZERO Property Tax, as well as ZERO Income Tax (YES, you read it right!)

Looking for a Real Estate Investment?

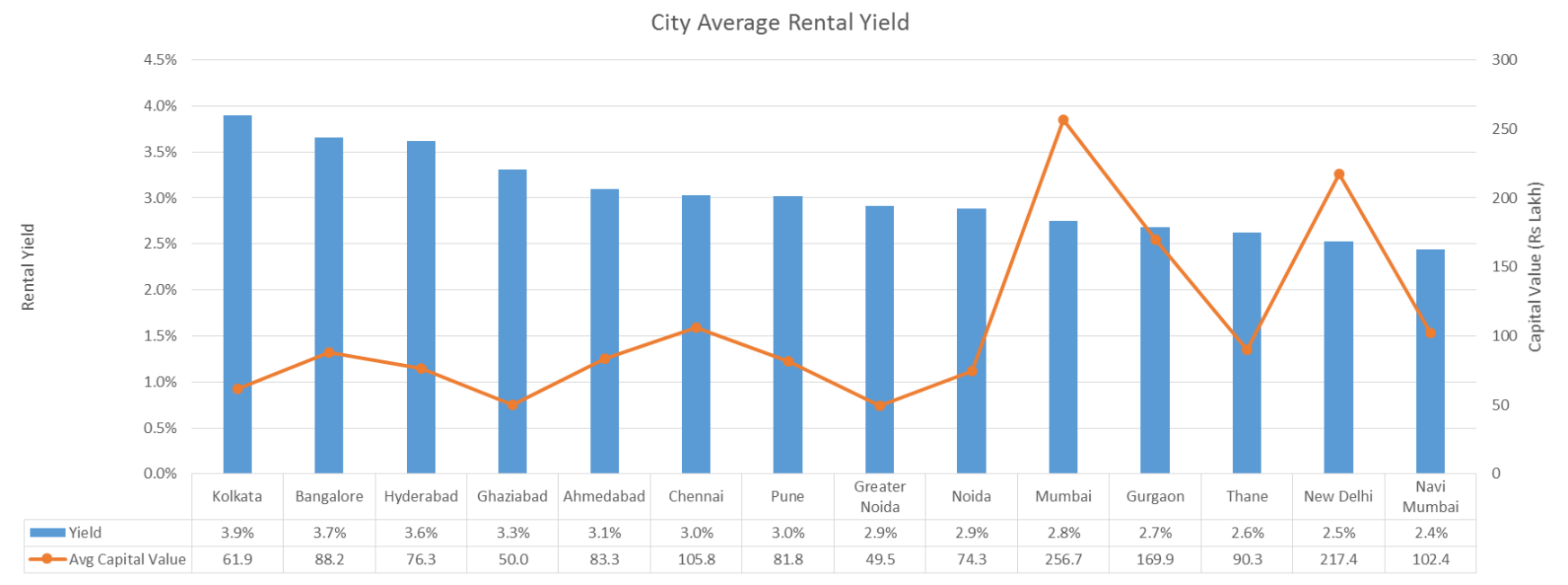

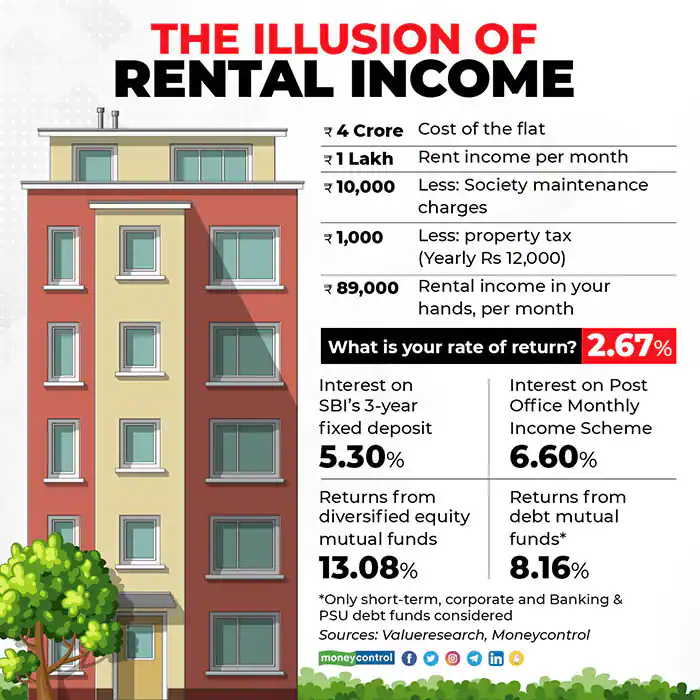

How much Rent can you expect from a Rs.1 Crore Property or Apartment?

The reality is that the Rental Yield is ONLY 3-4% in India

Considering Rental Yield as 3.9%, which is above average...

For a Rs. 1 Crore Apartment

Annual Rental Income:

Rs. 3.9 Lacs

Monthly Rental Income:

Rs. 32,500/-

Other Monthly / Yearly Expenditures in maintaining a Physical Flat

That leaves the Monthly Rental Income to be less than Rs. 29,500/- for a Rs. 1 Crore Apartment...

Doesn't Look Impressive!!!

Introducing eFLAT...

An Investment which beats Physical Real Estate on any day...

Because It Requires...

And How about getting around Rs. 85,000/- each month, instead of Rs. 29,500/- and that too Tax-Free & Guaranteed?

No more worring about your monthly rental cashflow when Old Tenants vacant your physical flat. With eFlat you get Guaranteed Cashflow each and every month for 25 Long Years, no matter what. And yes, it will be a WRITTEN GUARANTEE...

Your monthly income from eFlat is 100% Tax-Free!!! This is by Law because of how eFlat investment is designed, NOT because of any Tax Loophole.

It's one of the safest kind of investments which remains unaffected to any Real Estate Crash or Stock Market Crash, because it is based on a 200+ Year Old Investment Vehicle.

Rs. 85,000/-

vs

Rs. 29,500/-

Which one will you choose as your Monthly Income?

But the Deal gets even better...

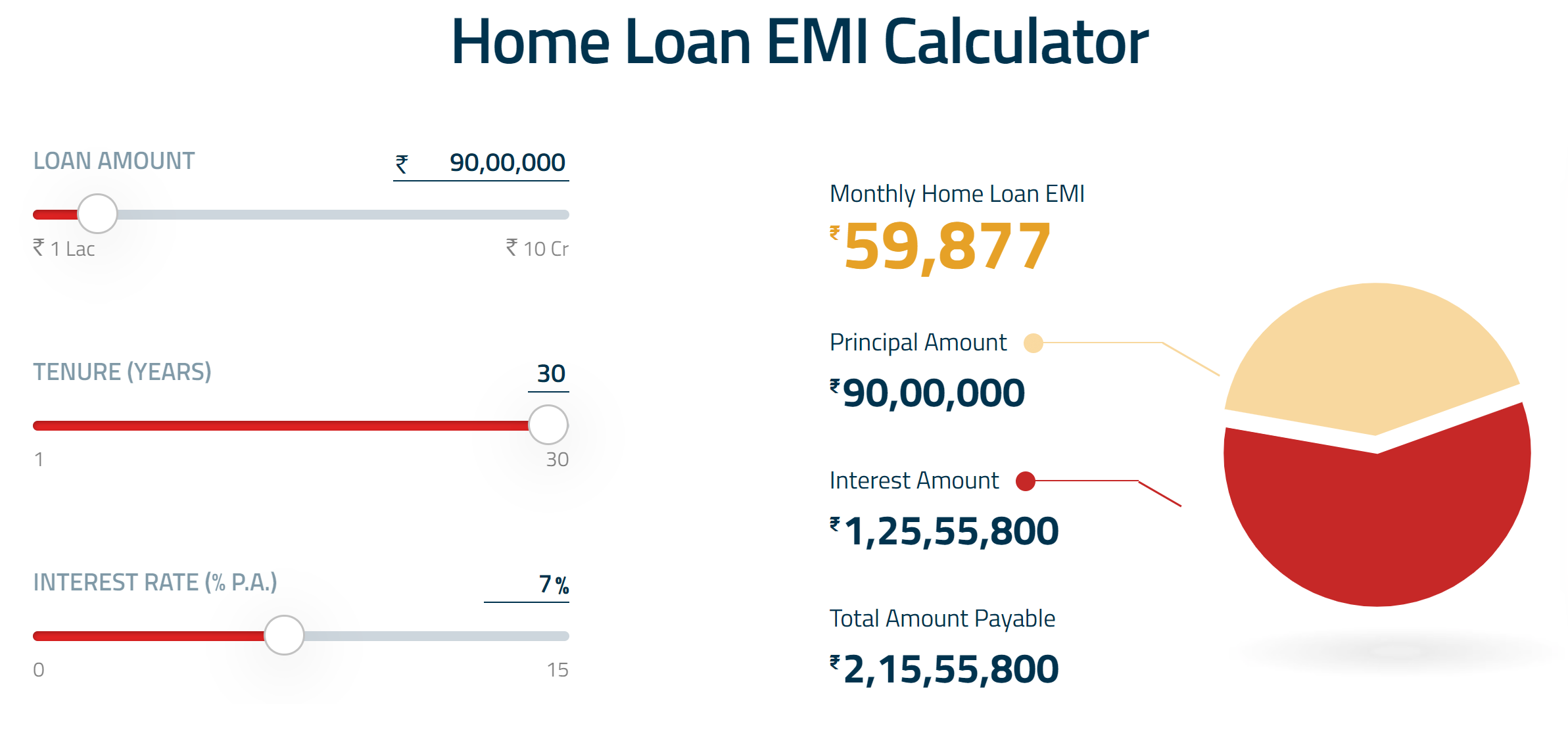

Now let's look at the Cost of owning a Rs. 1 Crore Physical Flat

Down Payment:

Rs. 10 Lacs

Loan Amount:

Rs. 90 Lacs

@ 7% Interest for 30 Years

Total Loan Amount Payable:

Rs. 2.15 Crore

(see Home Loan Calculator below)

Stamp Duty Cost:

Rs. 7 Lacs

(7% of Cost of Flat)

Agent Commission:

Rs. 2 Lacs

(2% of Cost of Flat)

Total Cost to Own a Rs. 1 Crore Property

Rs. 2.35 Crores

How much does a Rs. 1 Crore eFLAT cost to own?

Well, unlike a physical flat, an eFLAT will NOT cost Rs. 2.35 Crores,

But a 1 Crore eFLAT will cost just that Rs. 1 Crore ONLY

Because It Requires...

And Guess What.....

You will even get back your Initial Investment of Rs. 1 Crore at the end of the maturity period!

[check below...]

So How Does an eFLAT Investment Work?

The eFlat is a virtual investment product offered by the joint venture of Max Life Insurance and Axis Bank.

If your main aim to buy a Real Estate Property is Monthly Cashflow in the form of rent, then investing in a product like eFlat can give you a much better Cashflow (as demonstrated above), and that too Guaranteed & Tax-Free, without the headaches of maintaining any real estate property.

Below are the steps to invest Rs. 1 Crore in an eFLAT Investment Product and how it works.

Step 01

You pay Rs. 10 Lacs each year for the next 10 Years to fund your investment.

Step 02

You wait in the 11th Year.

Step 03

From the end of 12th year, get a Guaranteed Monthly Income of around Rs. 85,000/-, absolutely Tax-Free, deposited into your bank account.

Step 04

Keep getting your cash flow of around Rs. 85,000/- each & every month for the next 25 years, without any break, without worrying about any Tenants or without paying any Taxes or Maintenance Cost

Step 05

At the end of those 25 years, your Entire Investment of Rs. 1 Crore will be RETURNED to you as well, which again will be 100% Tax-Free.

Step 06

Enjoy your retirement, since your 25 years' Cashflow problem has been fixed and is guaranteed to be paid, EVEN IF the Stock Market crashes or the Real Estate Market evaporates or the Economy tumbles.

If You Find eFLAT to be a better investment than a physical real estate property, then please Sign Up in the form below for more details...

Faq.

This product is eligible for tax benefits under section 10(10D) of the Income Tax Act, 1961 as the condition of "premium payable for any of the years during the term of policy not exceeding 10% of the sum assured" is satisfied considering total sum assured during the policy term is at least 11 times the premium paid any year.