The Secret of Your Ultimate Health Benefits Plan Revealed : Get Paid to Get Well, 100% Guaranteed & Tax-Free

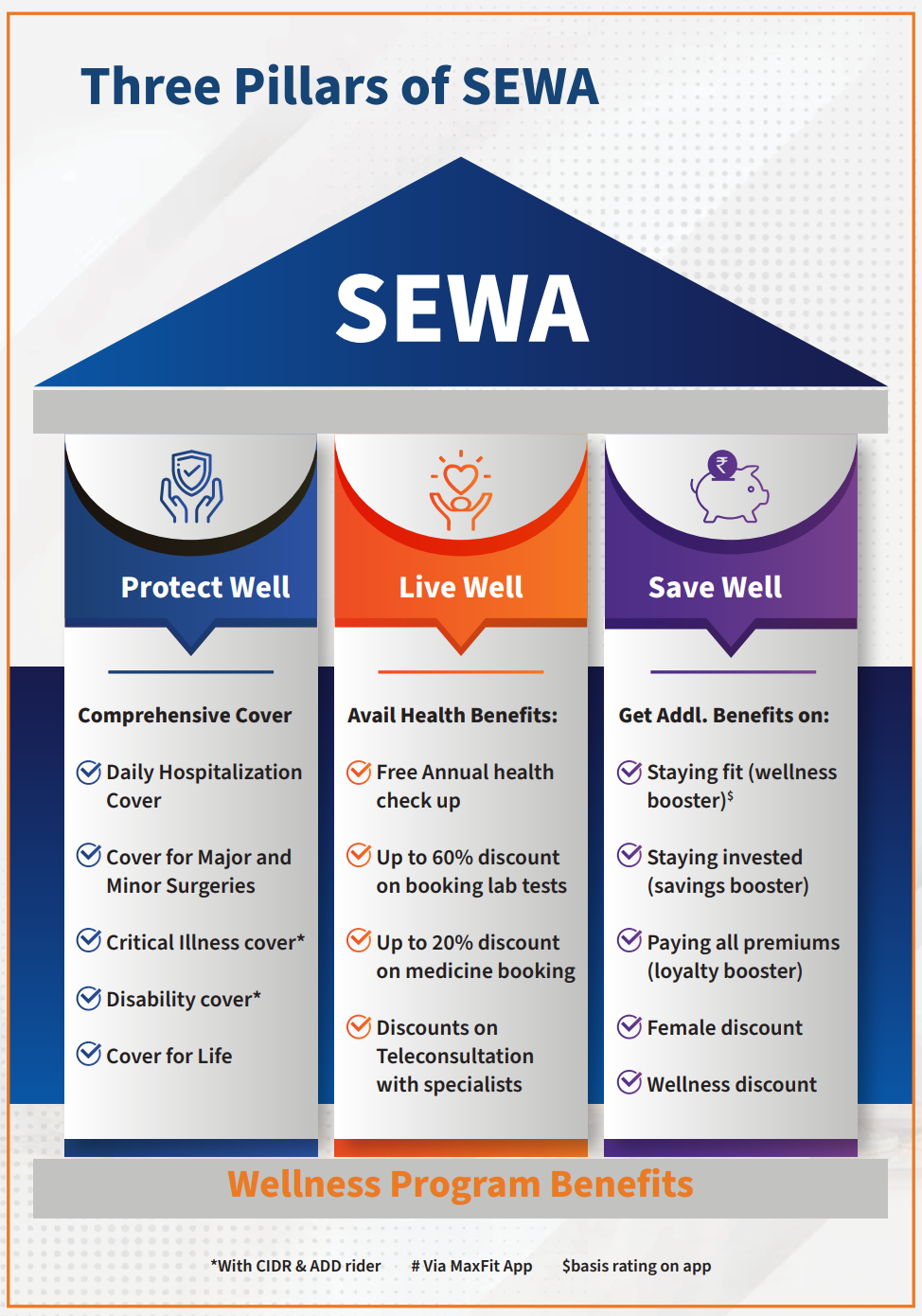

Introducing the Secure Earnings & Wellness Plan (SEWA)

Hey there, Friends!

Today, I've got something seriously exciting to share with you. I mean, we're talking about a game-changer in the world of insurance – a health benefits plan that's not just rock-solid but also guarantees you a return of premiums. That's right, it's time to dive into the world of SEWA!

Now, I get it. Insurance isn't typically the sexiest topic in the financial world, but hold onto your wallets, because SEWA is about to blow your mind.

So, what's this SEWA thing all about?

SEWA is the brainchild of the brilliant minds over at Max Life Insurance. But it's not your average insurance plan; it's a powerhouse combo of fixed hospitalization benefits, a death cover, and a mind-blowing guarantee of premium returns. It's like the superhero of insurance plans.

Let's break it down a bit. With SEWA, you get two incredible benefits. First off, there's the health benefits side of things. And here's the kicker – these benefits are rock-solid, locked in, and guaranteed.

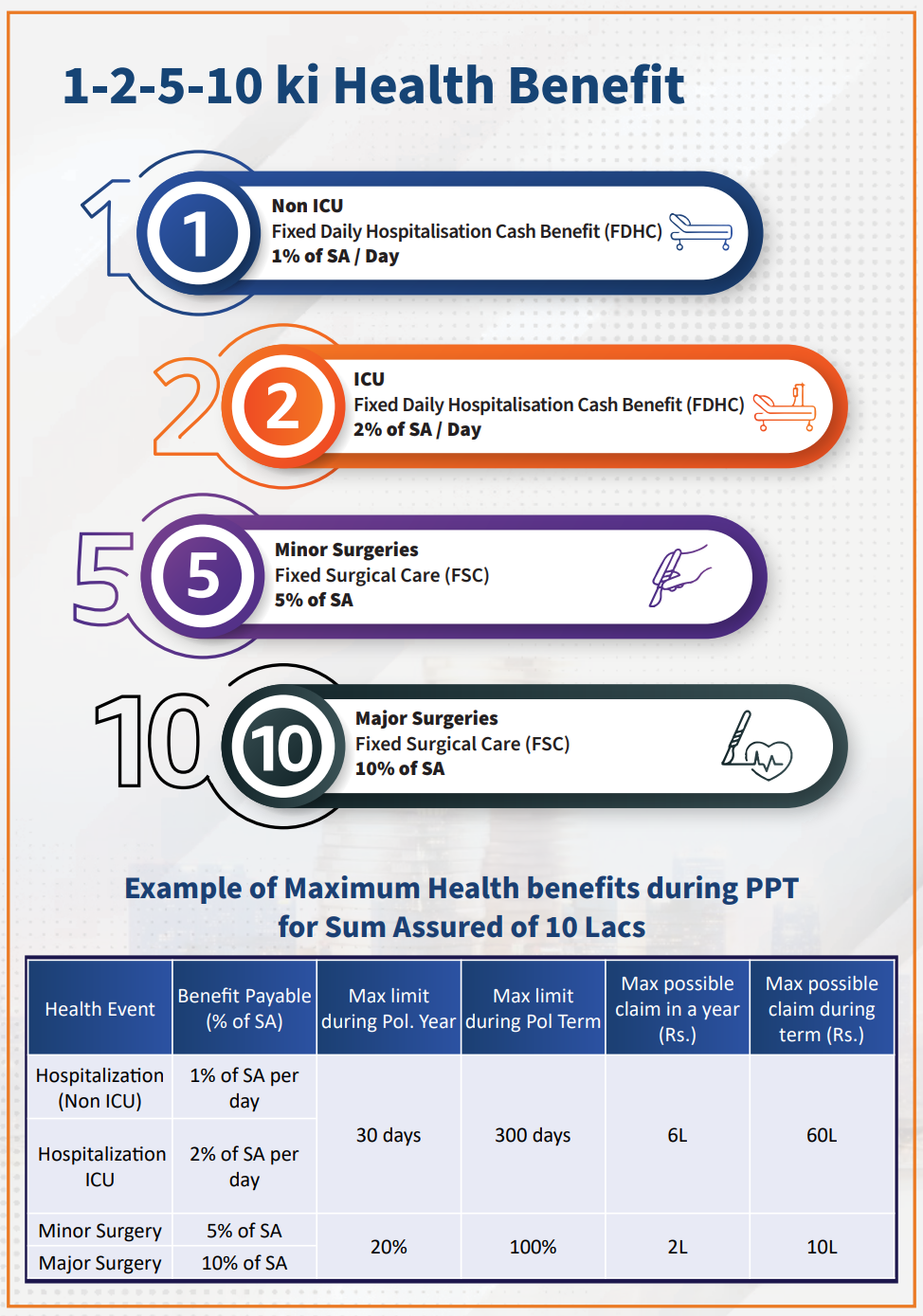

Say you've got a Sum Assured (SA) of 10 lacs INR, and you find yourself in the hospital.

If it's a non-ICU stay, you're cashing in on 1% of SA daily, that’s 10k INR each day.

ICU? That's 2% of SA per day, that’s 20k INR each day.

Minor surgery? You're looking at a sweet 5% of SA, that’s 50k INR lumpsum.

And for a major surgery? Brace yourself for 10% of SA, that’s 1 lac INR lumpsum.

Now, picture this:

You spend 3 days in the ICU, undergo a major surgery, and kick back in a regular bed for a week. No matter if your hospital bill resembles the national debt or just a small fraction of it, you're pocketing a cool 2.3 lacs INR.

(3x20,000 + 1,00,000 + 7x10,000) = 2.3 lacs INR.

And guess what? You only need to send them a photocopy of those bills because your original ones are being handled by your existing health insurer. SEWA is all about making your life easier.

Now, here's where it gets interesting – that 2.3 lacs INR you just earned? It won't even make a dent in the guaranteed return of premiums you're getting when this plan matures.

It's like hitting the jackpot every time you land in a hospital bed.

I can hear you asking, "But hey, what if I already have an existing health insurance and they take care of my hospital bill?" Well, my friend, you're in luck. SEWA pays out claims even if your existing health insurer has already settled the bills. Yep, you read that right. Double-dipping for the win!

Because your existing health insurance or mediclaim policy is picking up the tab for your hospitalization costs, whether it's a hefty 3.8 lacs INR or a modest 1.2 lacs INR, you're not paying a single rupee or a small percentage for that since your existing insurance is cashless policy.

Yet (and here’s the deal), when you again submit that same claim with SEWA, you're still looking at a sweet 2.3 lacs INR landing in your bank account (considering the example case above).

How’s that possible? 'Cause that's how SEWA rolls – fixed, guaranteed, and as steady as an old oak tree. Since it’s a health benefits plan and not a pure health insurance plan, IRDA has approved it to give away claims, even if an existing health insurer has already settled your hospital bills.

So, here's the real kicker:

SEWA isn't just about giving you back your premiums 100% guaranteed. It's also like a money-making machine that lets you recoup the premiums you've been paying for your existing health insurance or mediclaim, if and whenever you get hospitalized. Think about it... It's like getting two pies and eating them both!

I know I know, you must be thinking that it’s too good to be true, after all how much can they allow us to claim on a Sum Assured of say 10 lacs INR. Well buckle up your seat belt guys, for what you will learn next can make you fall from your chair....

Here it is... You can claim up to a total of whopping 70 lacs INR throughout your policy term through your hospitalizations, and even then it won't put a dent in that guaranteed maturity amount.

Plus, hold onto your hat, because this part's a real showstopper

You'll earn interest on top of your premiums when SEWA matures. That's right, folks, it's like the icing on the cake!

Now, let me hit you with some more good news

Even if life takes an unexpected turn, and you can't pay your premiums anymore, SEWA's got your back. As long as you've paid at least 3 years' worth of premiums, they'll still be returned to you guaranteed when the plan matures, even if you've had to make a claim during those 3 years. Now that's what I call financial peace of mind.

Oh, and one more thing

Every single dime you get from SEWA, whether it's a claim or a maturity amount, is 100% tax-free. Yeah, you heard me right. It's 100% legal, approved, and income-tax-free. So, you get to keep that cash without the Income Tax Department breathing down your neck.

But hold on, we're not done yet

SEWA isn't just about hospitalization benefits and guaranteed return of premiums. It's also got a nifty Death Benefit. So, if the unthinkable happens, and you shuffle off this mortal coil, inside or outside the hospital, your family's got a safety net. And get this – even if you've already made multiple claims for your hospitalizations, SEWA still has their back.

So, there you have it, my friends – SEWA is a game-changer

It's like having a financial superhero in your corner, ready to swoop in when life throws you a curveball.

It's got...

- fixed hospitalization benefits

- guaranteed return of premiums (with interest!),

- covers your family in case of your demise,

- and it's all 100% tax-free.

It's not just a plan; it's a promise.

It's a win-win-win-win situation.

If you're still scratching your head or have any questions about SEWA, don't hesitate to reach me out. I'm here to help you navigate this exciting opportunity, just like I've helped many others in their financial journey. So, seize the day, grab SEWA by the horns, and secure your financial future like the champion you are!

Until next time, keep hustling and dreaming big.

Remember, when it comes to SEWA, the only thing you'll be wondering is why you didn't jump on board sooner. It's time to ride the wave of guaranteed premium returns – let's make it happen together!

Interested to discuss over a call?

The Plan Highlights

Guaranteed Return of Premiums

First ever Health Plan with 100% of Return of Premiums Guarantee, even if there are multiple claims due to hospitalization and/or minor or major surgeries.

In-Built Health Cover

Superior Health Cover at every Life Stage, with double claim facility.

Yes, you can claim for your existing health policy and SEWA both for same hospitalization.

Multiple Boosters to increase your Returns

Not only guaranteed return of premiums, but you can also double your return with the help of multiple boosters like Loyalty Boosters, Wellness Boosters and Savings Boosters.

Health Benefits with Life Coverage

It not only pays back your hospitalization cost, but also provides a hefty death benefit to your nominee, if something happens to you, whether inside or outside the hospital.

Interested to discuss over a call?

The Best Time to get SEWA is Now!

Protect your family as well as earn from your hospitalizations, 100% tax-free. And don't forget all your premiums will be returned to you 100% guaranteed at the end of maturity.

You are fully protected by our 100% Return of Premium Guarantee

Even if you stop paying premiums after the 3rd year of your policy and even if you have claimed for any of your hospitalizations during those 3 years, still you get all your premiums back (with Interest) at the end of maturity.

Frequently Asked Questions

Yes, Insurance would usually pay for claims requiring a continuous hospital stay of at least 24 hours.

Yes, you can claim for your existing health policy and SEWA both for same hospitalization

Generally, we provide the decision on claims within 7 (Seven) working days of the receipt of the last ‘necessary’ document. However, in certain special cases, the timelines increase. These take no more than 30 days

a. You can claim for maximum of 30days hospitalization in a policy year.

b. And up to 4 surgeries (including major & minor) subject to 20% of the Sum Assured

There is a waiting period of 90 days during which claims are not payable. This clause is not applicable for Accident related Claims

List of necessary claim documents to be submitted for reimbursement are as following:

i. Claim form completely filled and duly signed.

ii. Copy of photo ID of patient / KYC documents if applicable.

iii. PAN card if claimed amount is more than 1 Lakh

iv. Photo copy of Hospital Discharge summary

v. Photo copy of Hospital final Bill or Hospital Bill summary

vi. Original cancelled cheque with pre- printed name of proposer on it.

© 2025, 10xWealthSchool.com